October 16, 2020

.png)

Today, Bernstein Litowitz Berger & Grossmann LLP announces the filing of a second case against Allianz Global Investors. BLB&G client City of Milwaukee Employes' Retirement System (CMERS) filed suit in the Southern District of New York on October 16, 2020, seeking to recover the losses it incurred as a result of negligence and breaches of fiduciary and contractual duties by Allianz.

This follows the July filing by Arkansas Teacher Retirement System (ATRS), also represented by BLB&G, of the first complaint against Allianz and its affiliates seeking to recover losses incurred in its Structured Alpha investments. Allianz’s marketing and management of the Alpha Funds are now being investigated by the SEC. Both cases are a result of the proprietary investigation conducted by BLB&G's Allianz Structured Alpha Funds Team, which includes lawyers, former prosecutors, certified fraud examiners, and financial analysts, and which brought to light Allianz’s mismanagement of the Structured Alpha Funds and the manipulation of a key market index.

The Structured Alpha Funds utilized an investment strategy designed to provide stable returns and protection during a market downturn. However, BLB&G’s analysis of select portfolio data for the Structured Alpha Funds revealed that Allianz deviated dramatically from this market-neutral strategy and lacked any meaningful protection against a market downturn. BLB&G’s investigation also uncovered evidence that once the Alpha Funds started incurring losses in February 2020, Allianz took a series of actions in contravention of its contractual and fiduciary duties that exacerbated the Alpha Funds’ losses, and may have engaged in market manipulation in a desperate attempt to mitigate those losses. As Institutional Investor reported on July 11, 2020: “Notably, the lawsuit makes public for the first time a rumor circulating among certain volatility-market experts: that someone manipulated VIX futures prices in mid-March to secure more favorable settlement terms.”

Allianz’s departures from the Structured Alpha Funds’ investment mandate directly contradicted the warnings of Allianz SE's own chief economist, Mohamed El-Erian. Beginning in February 2020, El-Erian cautioned that the then-burgeoning pandemic would have substantial market ramifications, and urged investors to “resist our inclination to buy the dip.” But that is exactly what Allianz did in February and March 2020—positioning the Structured Alpha Funds to generate returns if volatility decreased and equity prices increased. As Allianz SE’s economist warned, when the pandemic's impact on the markets unfolded, increases in volatility and decreases in the equity markets generated massive losses for the Funds.

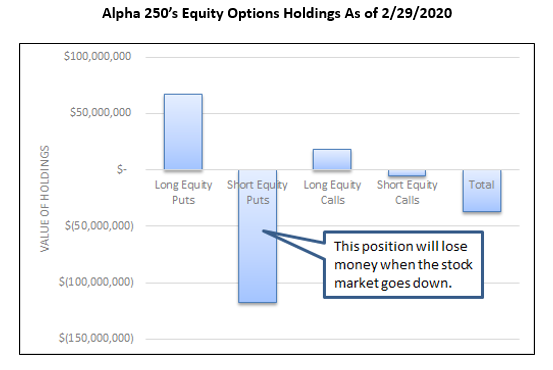

For example, as shown in the chart below, as of February 29, 2020, the Structured Alpha 250 Fund was positioned such that it would generate a return if the equity markets increased in value. But those positions would generate significant losses if the S&P 500 continued to decline. More specifically, the Fund had sold short equity put options worth $117 million, while purchasing (long) equity put options worth only $67 million. In other words, the Structured Alpha 250 Fund was not “market-neutral” but was in fact betting on an increase in equity prices.

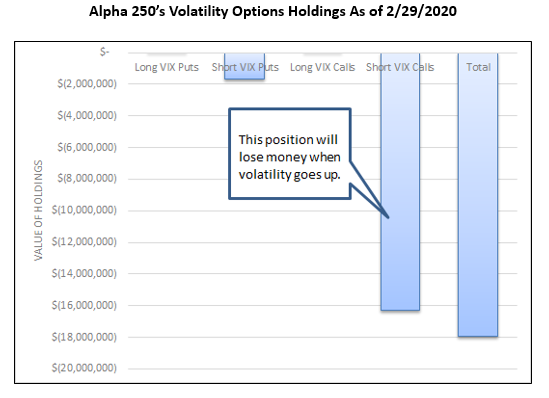

Similarly, the Fund’s position in volatility options was not “market-neutral,” but would instead decline in value if there was an increase in volatility. As shown below, the $16 million short position in volatility calls would lose money when volatility rose, which typically happens when the market suffers a sharp decline. This, again, was contrary to the investment mandate that the Funds be “market-neutral” and hedged against volatility increases.

Moreover, while the Structured Alpha Funds were supposed to have positions in place to protect against “a severe downside market move, such as the Black Monday of 1987,” in reality, a review of the Alpha 250 Fund’s positions showed they lacked any meaningful downside protection whatsoever.

Allianz’s mismanagement of the Alpha Funds caused massive losses, and its refusal to account to its clients left ATRS with no choice but to take action to recover its losses by filing suit. BLB&G is actively working with numerous other institutional investors who suffered losses as a result of this mismanagement, and is focused on helping our clients find justice in this difficult situation.

Investors who suffered losses as a result of investments in the Alpha Funds are encouraged to contact BLB&G’s Allianz Structured Alpha Funds Team to discuss BLB&G's investigation.

External Links (links will open in a new window):

Citywire Allianz Faces Questions From SEC About Embattled Vol Funds: Following A Lawsuit From The Arkansas Teacher Retirement System, The U.S. Regulator is Asking Questions About Some AllianzGI Structured Alpha Funds

Reuters Allianz Faces SEC Information Request For Its Structured Alpha Funds

Pensions & Investments Arkansas Teachers Sues Allianz Global Investors Over Absolute-Return Strategies

New York Law Journal Lawsuit Targets Allianz Over $774M In Losses Amid Pandemic Downturn

Institutional Investor Teachers’ Pension Lost $774M in Allianz Volatility Funds: Lawsuit